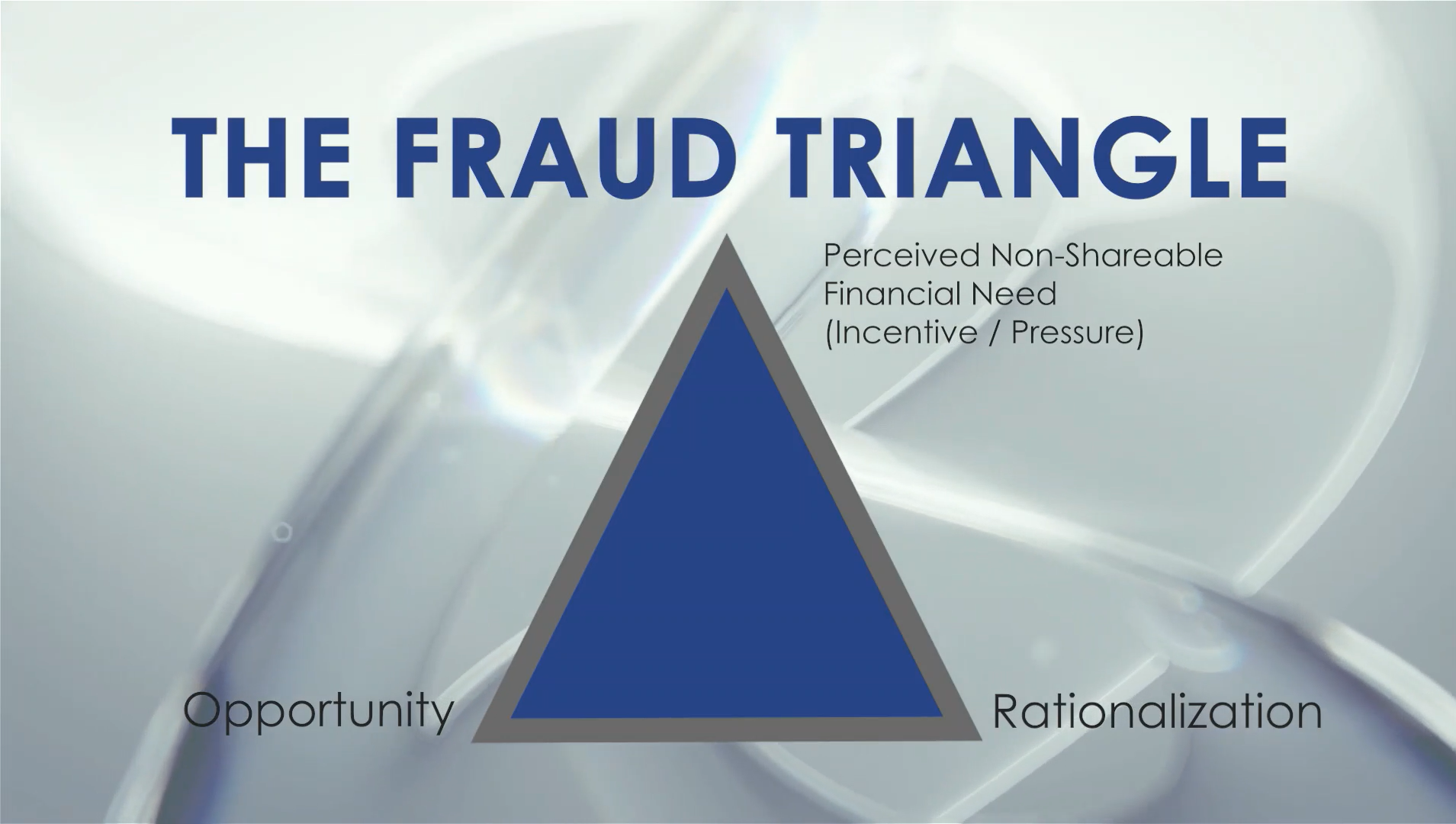

The Fraud Triangle: Pressure, Opportunity, and Rationalization

As a Certified Fraud Examiner, my passion and desire is to teach businesses about fraud prevention and early detection. Education has never been more crucial to protecting yourself, your business, and your employees from loss. Each business, however big or small, should have a thorough understanding of their vulnerability to internal fraud.

Internal Fraud—Fraud that is perpetrated against an organization by its own people.

Most businesses that experience fraud are surprised. They are caught off guard by the theft and loss caused by a member of their own work-family. We believe this is because most people misunderstand why fraud happens in the first place. Most assume that fraud is committed by a mastermind criminal whose sole interest in the company was always to steal money. They can’t imagine that someone they trust is capable of fraud. Sadly, this is just not the case.

In my 35 years of investigating over 400 cases of fraud, only about 5% were perpetrated by someone crafting a scheme to get rich due to greed. Someone saw money or opportunity, and they took it just because it was there.

So what about the other 95% of fraud cases? Who is stealing if it isn’t pure greed seekers? 95% of the time we investigate fraud, the perpetrator turns out to be someone most would consider a “decent” person. They simply found themselves caught in what we call The Fraud Triangle.

The idea of the Fraud Triangle has been around for decades. Donald R. Cressey hypothesized about the motivations of fraud in the 1940s, explaining how “trusted persons become trust violators” through evolving circumstances in their own lives. This concept has proven accurate and unchanged.

- Pressure—A “non-sharable” problem that creates pressure in the life of an employee. A sick family member. A child going to college. A spouse that has lost a job. A reduction in pay due to a global pandemic. Pressing debt. All of these issues that arise in a person’s life can create pressure that makes them look for ways to help themselves--ways to just “get them through” a tough time. Experiencing pressure makes the next element of the triangle much more enticing.

- Opportunity—A chance to take money or resources. Companies with poor internal controls and infrastructure leave many opportunities for people to steal without being noticed. If a person experiencing strong pressure has a good opportunity to help themselves, it is hard to resist. The 10-80-10 Rule of Ethics states that given an opportunity, 10% of people will ALWAYS steal, and 10% of people will NEVER steal. But the remaining 80% will fluctuate from ethical to unethical behavior depending on their personal circumstance. When under pressure, this 80% will entertain the final element of the triangle.

- Rationalization—A person’s ability to justify their choice to commit fraud and maintain that they are a good person. This is a trait we all have to convince ourselves that what we are doing is not wrong. Rationalization looks different for each perpetrator. Disgruntled employees justify theft by claiming they are underpaid to begin with and therefore deserve a little extra. Individuals defending their moral compass explain to themselves that they will pay it back when they have escaped the pressure they are under. This is the final step before committing fraud. They have a need, they have an opportunity, and it can be rationalized in some form.

Our Responsibility to the Triangle

So what do we do with this information? We certainly don’t want to assume every member of our organization is secretly plotting to steal. So how can we protect our interests? What can we do to deter fraud and still operate with trust within our company?

Design an Anti-Fraud Program; you begin by addressing the Triangle. If any side of the triangle is removed, we greatly deter the occurrence of fraud in the workplace.

- Pressure—Addressing pressure within our workforce serves not only our defense against fraud, but serves the people in our business we care most about. Create a workplace environment where employees feel open to discussing pressures they are experiencing. Sometimes, just providing a listening ear can ease the perceived pressure in a person’s life. You can also consider directing employees to credit counseling, financial planning, or even low-interest, internal loans to help alleviate financial stress.

- Opportunity—If you have not already, start building an anti-fraud program in your business. This includes everything from having everyone sign a Fraud Policy and a Fraud Reporting Policy, to developing strong Internal Controls. Ultimately, leave no viable option for employees to easily take something without being noticed. By removing these opportunities, you not only lessen occurrences of fraud, you eliminate temptation employees might face when under pressure.

- Rationalization—Talk about fraud. Talk about ethics. Talk about your team. Foster a community of belonging. Create a place where employees feel loyalty because they know they are cared for. In doing so, the workforce experiences an increase in the perception of detection. If I am considering fraud, the stronger the perception of detection, the less likely I may be to steal.

Understanding the origins and motivations of internal fraud is key to prevention and early detection. We encourage you to explore creating a strong Anti-Fraud Program for your business to protect your people, your business, and your future endeavors.

_______________________________________________________________________________________________________

Additional resources:

Dawson Forensic Group—Visit our website for an overview of our services, as well as anti-fraud advice on our blog.

Internal Control/Anti-Fraud Program Design for the Small Business—Dawson’s book is a comprehensive guide for designing your own Anti-Fraud Program.

Fraud Awareness Resources—The Association of Certified Fraud Examiners provides numerous resources for small businesses to educate themselves and their organizations about internal fraud.