Building a Stronger Business Community Starts Right Here in Lubbock

Texas is proud of our business-friendly environment, providing opportunities for Texans across the state to find economic success and stability. Historically, hard work and a strong community have always been required for life in West Texas—the past few years have been no different.

While the COVID-19 pandemic put a strain on our families and communities, Lubbock came together and demonstrated our combined strength. Now as prices of consumer goods and gas begin to rise, we are facing a new economic challenge in inflation and additional financial burden on our community in the form of higher taxes. The struggle for families and local businesses continues.

Yet, despite these hurdles, some members of Congress want to add additional burdens by raising taxes to pay for exorbitant federal programs. They hope to increase the Global Intangible Low-Taxed Income (GILTI), which levies a fee on the foreign earnings of American businesses, as well as the corporate tax rate, believing these hikes will only impact massive corporations who can afford to pay. But instead, it will be businesses of all sizes, including those right here in Lubbock, that will bear the cost.

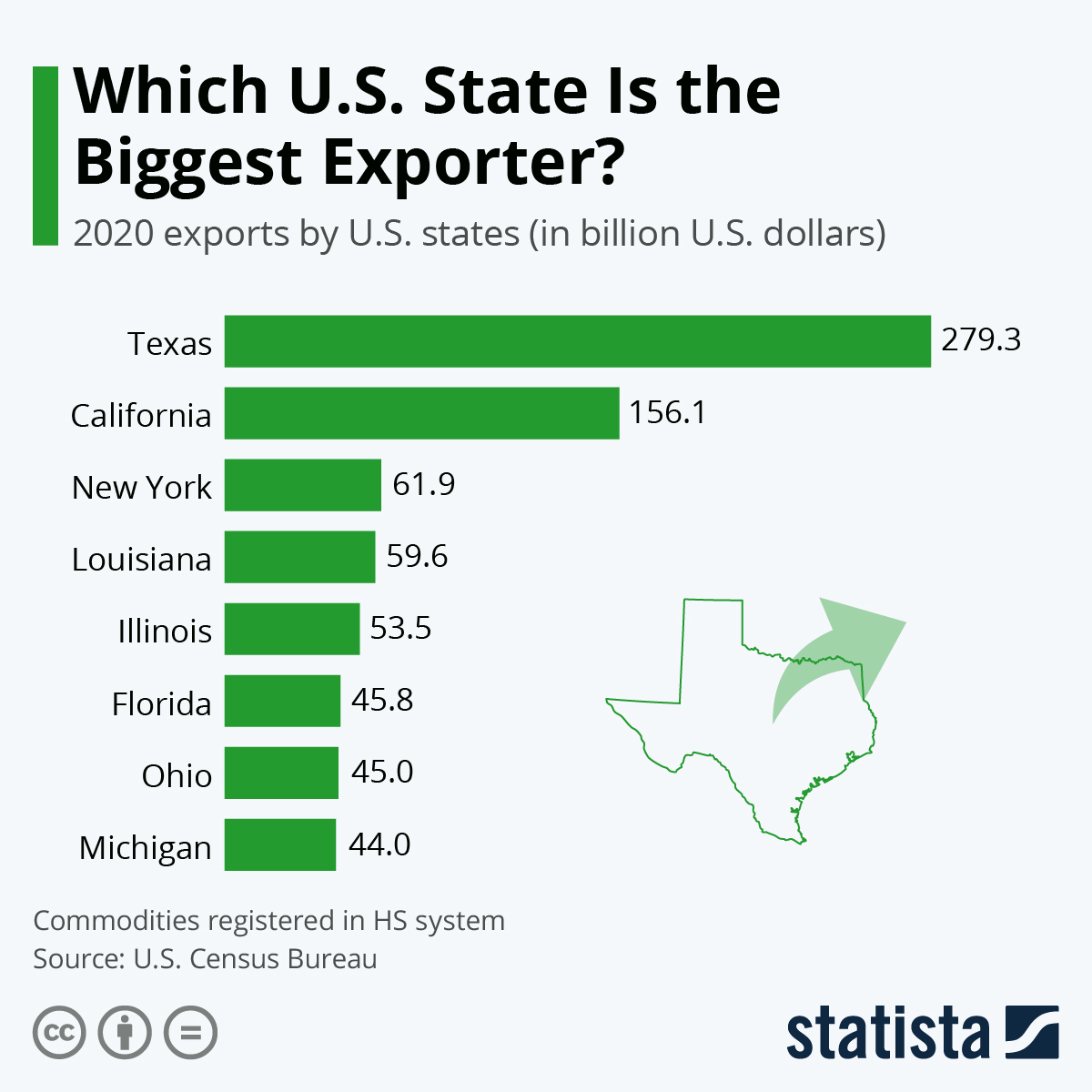

Dating back to 2000, Texas has been the largest exporting state in our nation, sending nearly $280 billion worth of products every year to markets all over the world. Increasing the GILTI rate on American multi-national corporations could be especially dangerous to our state as it would hurt our businesses’ ability to stay competitive on the international stage by offering new, cutting-edge products and services at a reasonable rate.

Not only could an increase in the GILTI rate hurt our Texas businesses, but it could also hurt jobs. According to a recent study from the Texas Association of Business, increasing the GILTI rate could cost our state over 100,000 good-paying jobs.

Raising the corporate tax brings its own set of challenges, too.

Increases in corporate taxes do not just target businesses, but workers too. Historically, workers are the ones most impacted by increases as it makes it difficult for businesses to raise wages and promote job growth. Statistics show between 75%-100% of these types of tax increases are passed onto everyday workers.

While some argue we need additional revenue to fund a growing country, we need to put a priority on implementing smart policy decisions that will help our state and nation continue to take two steps forward, not one step back. Action like this needs to start with us by standing together and letting our leaders know that we need them to continue to fight for Lubbock’s businesses and community.